Occasional Teachers' Bargaining Unit | |

Teacher Tax Credit

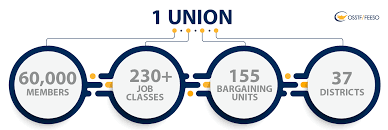

Understanding Collective Bargaining

Public Education- It's for Everyone

Early Learning

More Professional Support

Professional Judgement and Collaboration

Funding Formula

University Funding & Oversight

School Boards Collective Bargaining Act

One Publicly Funded School System

More Professional Support

Professional Judgement and Collaboration

Funding Formula

University Funding & Oversight

School Boards Collective Bargaining Act

One Publicly Funded School System

The School Board Collective Bargaining Act

The School Board Collective Bargaining Act (SBCBA)officially divides bargaining into issues to be dealt with at two tables.

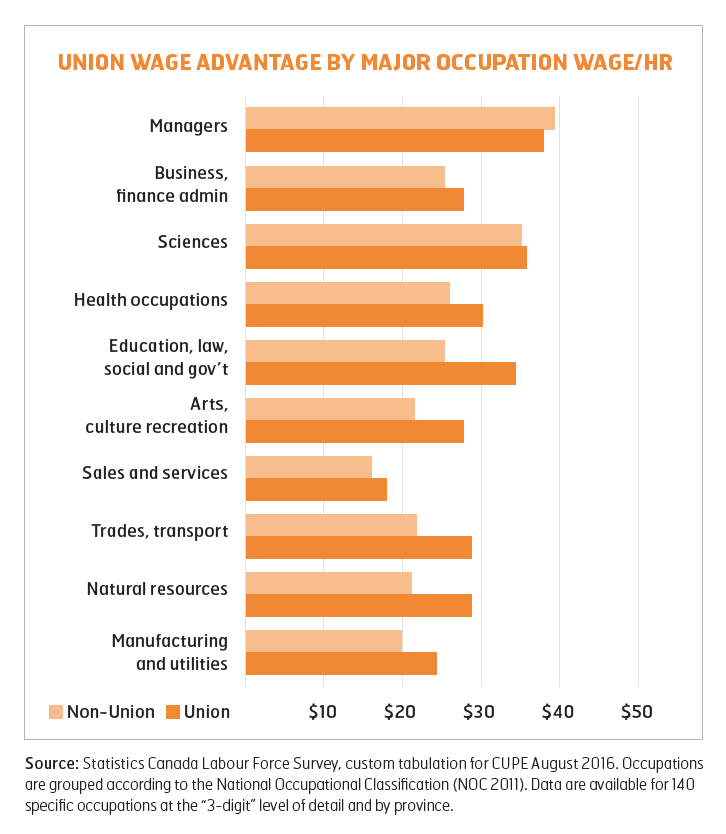

Privatization In the Education Sector and Beyond

Occasional Teacher Zone Maps

OT Zone Map 1

OT Zone Map 2

OT Zone Map 3

OT Zone Map 4

OT Zone Map 5

OT Zone Map 6

OT Zone Map 7

OT Zone Map 8

OT Zone Map 2

OT Zone Map 3

OT Zone Map 4

OT Zone Map 5

OT Zone Map 6

OT Zone Map 7

OT Zone Map 8

Union Myths Busted

Truth & Reconciliation Tool Kits